Exploring the Key Features of an Offshore Depend On for Riches Administration

Offshore counts on have gained interest as a critical tool for riches administration. They offer distinct advantages such as property protection, tax optimization, and enhanced privacy. These trusts can be customized to satisfy details monetary goals, protecting possessions from possible dangers. There are crucial factors to consider to maintain in mind - Offshore Trust. Understanding the intricacies of offshore trust funds might expose more than simply benefits; it could reveal potential obstacles that warrant careful idea

Comprehending Offshore Trusts: A Primer

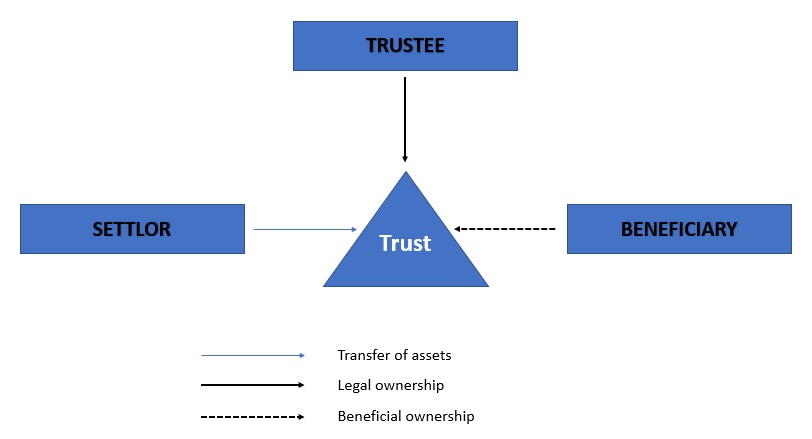

Although overseas trusts might seem complex, they act as useful economic tools for people looking for to manage and safeguard their wide range. An offshore depend on is a legal plan where an individual, called the settlor, transfers possessions to a trustee in an international jurisdiction. This structure enables for boosted personal privacy, as the details of the trust fund are often personal and not subject to public scrutiny. In addition, offshore depends on can supply flexibility pertaining to possession monitoring, as trustees can be selected based upon experience and jurisdictional advantages. They can likewise be customized to meet certain financial objectives, such as estate planning or tax obligation optimization. Comprehending the lawful and tax ramifications of overseas trusts is vital, as guidelines differ substantially across different countries. On the whole, these trust funds offer a calculated strategy to riches management for those wanting to browse complicated economic landscapes while delighting in certain advantages that residential trust funds may not give.

Property Security: Protecting Your Riches

Asset security is a critical consideration for individuals seeking to protect their wealth from possible legal insurance claims, creditors, or unanticipated economic troubles. Offshore trust funds offer as a critical device for accomplishing this goal, offering a layer of safety and security that residential possessions might do not have. By transferring assets right into an offshore trust, people can create a lawful barrier in between their wide range and prospective complaintants, properly shielding these possessions from legal actions or bankruptcy proceedings.The territory of the offshore trust commonly plays a critical function, as several countries use durable lawful structures that secure depend on possessions from external claims. Furthermore, the privacy provided by overseas depends on can better prevent lenders from pursuing insurance claims. It is essential for individuals to comprehend the particular laws regulating possession security in their picked jurisdiction, as this understanding is basic for making the most of the performance of their riches administration techniques. On the whole, overseas trust funds represent a positive method to protecting wide range versus unforeseeable monetary obstacles.

Tax Obligation Benefits: Browsing the Monetary Landscape

Offshore depends on supply considerable tax advantages that can boost wide range monitoring methods. They supply possibilities for tax deferment, allowing assets to expand without immediate tax obligation implications. Furthermore, these trusts might supply inheritance tax benefits, better maximizing the economic heritage for beneficiaries.

Tax Obligation Deferment Opportunities

How can individuals utilize offshore depend maximize tax deferral possibilities? Offshore trusts supply a strategic opportunity for deferring taxes on revenue and funding gains. By positioning possessions in an overseas count on, individuals can gain from territories with beneficial tax obligation regimens, permitting potential deferment of tax obligations up until distributions are made. This device can be especially beneficial for high-income income earners or capitalists with considerable capital gains. In addition, the revenue produced within the trust fund may not undergo immediate taxation, making it possible for wealth to expand without the worry of yearly tax commitments. Guiding via the complexities of global tax obligation legislations, individuals can effectively utilize overseas depend boost their wealth management strategies while reducing tax exposure.

Estate Tax Obligation Benefits

Privacy and Confidentiality: Keeping Your Affairs Discreet

Preserving privacy and privacy is necessary for people looking for to shield their wealth and possessions. Offshore counts on provide a robust structure for securing personal information from public scrutiny. By developing such a trust, individuals can effectively divide their personal events from their financial rate of interests, ensuring that sensitive details remain undisclosed.The legal structures governing overseas trust funds frequently give strong personal privacy protections, making it tough for exterior events to gain access to information without consent. This level of confidentiality is specifically interesting high-net-worth people concerned about potential risks such as litigation or undesirable interest from creditors.Moreover, the distinct nature of offshore territories boosts personal privacy, as these locations typically enforce rigorous laws surrounding the disclosure of trust fund details. Individuals can take pleasure in the peace of mind that comes with recognizing their financial strategies are protected from public knowledge, consequently maintaining their preferred level of discretion in riches monitoring.

Versatility and Control: Tailoring Your Depend On Framework

Offshore trust funds give significant adaptability and control, allowing individuals to tailor their count on structures to meet specific financial and personal objectives. This adaptability allows settlors to pick various aspects such as the click here for more info kind of assets held, distribution terms, and the visit of trustees. By selecting trustees that line up with their objectives and worths, people can guarantee that their wealth is managed based on their wishes.Additionally, offshore depends on can be structured to suit altering scenarios, such as variations in economic requirements or family members dynamics. This means that recipients can receive circulations at defined intervals or under specific problems, offering more personalization. The capacity to customize trust fund provisions also assures that the depend on can develop in feedback to legal or tax changes, preserving its effectiveness with time. Eventually, this degree of adaptability empowers people to develop a count on that lines up seamlessly with their lasting riches management strategies.

Possible Downsides: What to Consider

What difficulties might people face when considering an offshore depend on for wide range management? While overseas counts on use numerous benefits, they also feature prospective downsides that necessitate careful factor to consider. One considerable problem is the cost related to establishing and preserving such a count on, which can consist of legal charges, trustee costs, and continuous management costs. Additionally, people might experience complex governing needs that vary by territory, potentially making complex conformity and causing fines otherwise complied with properly. Offshore Trust.Moreover, there is an intrinsic danger of currency fluctuations, which can influence the worth of the possessions held in the count on. Trust beneficiaries might also deal with difficulties in accessing funds because of the administrative procedures entailed. Public understanding and possible examination from tax obligation authorities can produce reputational threats. These factors require thorough research study and professional support prior to waging an offshore count on for wide range management

Key Considerations Prior To Developing an Offshore Trust Fund

Prior to establishing an overseas trust fund, people need to think about numerous vital variables that can significantly influence their riches management method. Lawful jurisdiction implications can influence the depend on's effectiveness and compliance, while taxation factors to consider might see this page impact general advantages. A comprehensive understanding of these elements is crucial for making informed decisions pertaining to offshore trust funds.

Lawful Jurisdiction Implications

When thinking about the facility of an overseas depend on, the option of lawful jurisdiction plays an essential role fit the trust's efficiency and protection. Different territories have varying legislations regulating trusts, consisting of laws on possession protection, personal privacy, and compliance with international standards. A territory with a robust lawful framework can boost the trust fund's authenticity, while those with much less stringent laws might position threats. In addition, the reputation of the picked territory can affect the count on's understanding among recipients and banks. It is important to review variables such as political security, legal precedents, and the accessibility of experienced fiduciaries. Eventually, selecting the appropriate jurisdiction is essential for attaining the desired objectives of property security and riches management.

Taxes Considerations and Conveniences

Taxation factors to consider considerably affect the decision to establish an overseas trust fund. Such depends on may use substantial tax obligation benefits, consisting of minimized income tax liability and possible estate tax benefits. In lots of jurisdictions, earnings generated within the trust can be strained at reduced prices or not in all if the recipients are non-residents. In addition, assets held in an overseas depend on may not go through residential estate tax, assisting in wide range preservation. Nevertheless, it is important to browse the complexities of global tax regulations to ensure compliance and prevent risks, such as anti-avoidance policies. Subsequently, people ought to consult tax specialists experienced in offshore structures to enhance advantages while adhering to suitable regulations and regulations.

Often Asked Concerns

Just how Do I Pick the Right Jurisdiction for My Offshore Trust fund?

Selecting the right territory for an offshore count on includes evaluating elements such as legal security, tax implications, regulatory setting, and personal privacy legislations. Each jurisdiction provides unique advantages that can considerably affect wide range monitoring techniques.

Can I Adjustment the Recipients of My Offshore Trust Fund Later?

The capacity to change recipients of an overseas trust depends on the depend on's terms and jurisdictional legislations. Generally, numerous overseas trust funds permit adjustments, yet it is necessary to speak with legal advice to ensure compliance.

What Is the Minimum Quantity Needed to Develop an Offshore Trust Fund?

The minimum amount required to develop an offshore trust fund varies significantly by jurisdiction and provider. Generally, it ranges from $100,000 to $1 million, depending upon the intricacy of the trust fund and linked fees.

Exist Any Type Of Legal Limitations on Offshore Trust Investments?

The lawful limitations on overseas trust financial investments vary by territory. Generally, policies may restrict particular asset types, enforce coverage demands, or limit deals with particular countries, making sure conformity with worldwide legislations and anti-money laundering steps.

Exactly how Do I Dissolve an Offshore Count On if Needed?

To liquify an overseas trust fund, one have to adhere to the terms described in the count on deed, guaranteeing compliance with relevant laws. Lawful suggestions is commonly advised to browse potential intricacies and establish all obligations are satisfied. By moving properties into an overseas depend on, people can create a legal obstacle in between their wealth navigate to this site and possible plaintiffs, effectively securing these properties from legal actions or personal bankruptcy proceedings.The jurisdiction of the overseas trust fund frequently plays an important role, as many countries provide robust lawful frameworks that shield trust fund possessions from exterior insurance claims. By developing such a trust fund, individuals can effectively divide their personal events from their economic rate of interests, guaranteeing that sensitive information remain undisclosed.The lawful structures regulating offshore trust funds usually supply strong personal privacy defenses, making it difficult for external events to gain access to information without authorization. Offshore counts on provide considerable flexibility and control, allowing people to tailor their trust structures to meet details financial and individual objectives. When thinking about the establishment of an offshore depend on, the choice of lawful territory plays an essential function in shaping the count on's performance and security. The ability to change recipients of an offshore count on depends on the depend on's terms and administrative legislations.